Cryptocurrency has become increasingly popular in recent years, with Bitcoin leading the charge. As more people become interested in investing in digital currency, it is important to be aware of the potential pitfalls and risks associated with this emerging market. While there are certainly benefits to investing in cryptocurrency, it is crucial to exercise caution and avoid these common pitfalls.

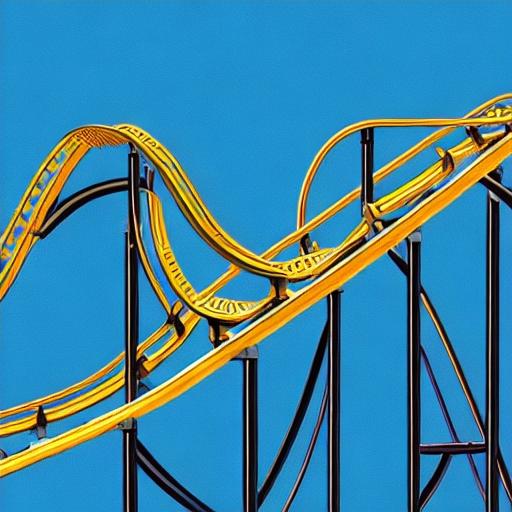

1. Volatility: One of the biggest risks associated with cryptocurrency is its extreme volatility. Prices can fluctuate wildly, sometimes in a matter of hours or even minutes. While volatility can present opportunities for significant gains, it also exposes investors to substantial losses. It is essential to carefully consider your risk tolerance and invest only what you can afford to lose.

2. Lack of Regulation: Unlike traditional financial markets, cryptocurrencies are not regulated or controlled by any government or central authority. This lack of oversight leaves investors vulnerable to fraud, market manipulation, and other illegal activities. It is crucial to thoroughly research and choose reputable cryptocurrency platforms and exchanges before making any investments.

3. Security Breaches: While blockchain technology is generally considered secure, cryptocurrency exchanges have been frequent targets for hackers. Several high-profile security breaches have resulted in significant losses for investors. It is crucial to secure your digital wallets and use reliable security measures, such as two-factor authentication, to protect your investments.

4. Ponzi Schemes and Scams: The cryptocurrency market has seen its fair share of Ponzi schemes and scams. These fraudulent schemes promise high returns or quick profits, often relying on the promise of new investors’ money to pay existing investors. It is essential to recognize the warning signs of a scam and avoid investments that sound too good to be true. Conduct thorough research and seek advice from trusted sources before making any investment decisions.

5. Lack of Understanding: Many people are attracted to cryptocurrency without fully understanding the underlying technology, risks, and potential challenges. It is crucial to educate yourself about blockchain technology, the specific cryptocurrency you are interested in, and the intricacies of the market. Lack of understanding can lead to poor investment decisions and potential financial losses.

6. Tax Implications: Investing in cryptocurrency can have significant tax implications. Transactions involving digital currencies may be subject to capital gains tax, and failure to report these transactions accurately can result in penalties and legal consequences. It is essential to consult with a tax professional to ensure compliance with relevant tax laws.

TAGS

cryptocurrency, risks, pitfalls, volatility, regulation, security breaches, scams, understanding, tax implications